There comes a time in our lives where we all need to begin budgeting and planning out our expenses. It’s not the most exciting thing in the world, but it is a good idea to plan out your budget for the month so you have a handle on all of your expenses and can stay on top of your money. There are many popular ways to budget especially now with the plethora of mobiles apps out there and available and in today’s battle is about two of the most popular budget apps out there for Android, Mint and YNAB.(You Need A budget)We’ll go through a few of the features of each application, then let you decide in the G+ poll which is the best for your needs. Who deserves to be the champion of budget apps? Let’s find out.

Mint.com

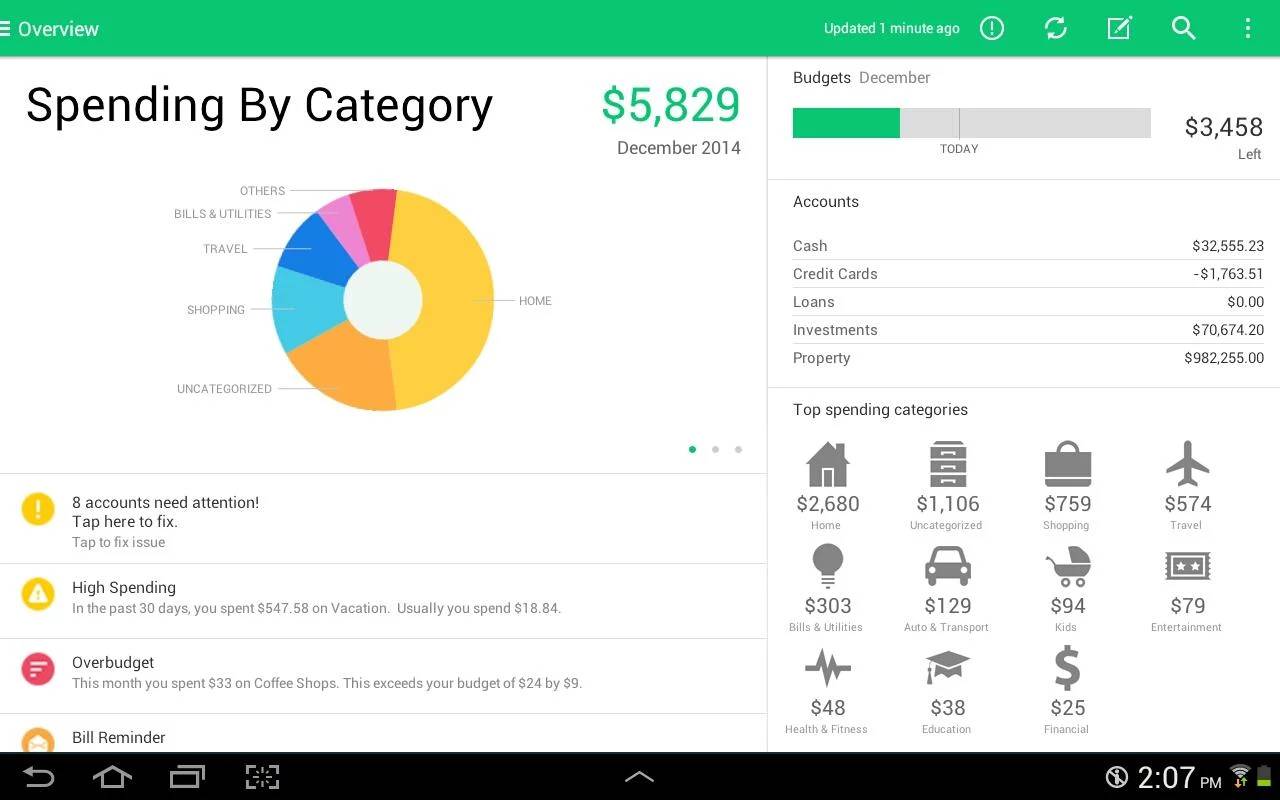

Mint.com is a free personal finance app developed by intuit aimed at one thing and one thing only, staying on top of your money. Mint has plenty of useful features for anyone looking to start budgeting out their expenses on a monthly basis, like fee alerts, recent transactions and high spending alerts, and one of the most useful, fast approaching budgets for a little reminder that you may have some bills coming due. Mint also allows you to see your credit score as part of your complete financial picture, which some may find useful To have in front of them at any time they want or need to know.

Mint also lets you consolidate all your personal finance accounts in one place and one easy to use application. You can store information for your 401k, your bills like water and sewage, electric, cable/internet, your credit card bills, and you can even enter in your own personal budgets for things like groceries or anything else you might have a recurring monthly expense for, like Playstation Plus in my case. Using the app you can set up bill reminders and bill alerts so you never miss a bill again, and we all know how much it sucks to miss bill payments, even if it rarely happens. You can also use the app to set financial goals like saving for a special purchase you’ve been thinking about. If you’re on a tablet, the Mint app will even show your finance accounts at a glance using big bold charts and graphs making it easier to see the bigger picture.

You Need A Budget(YNAB)

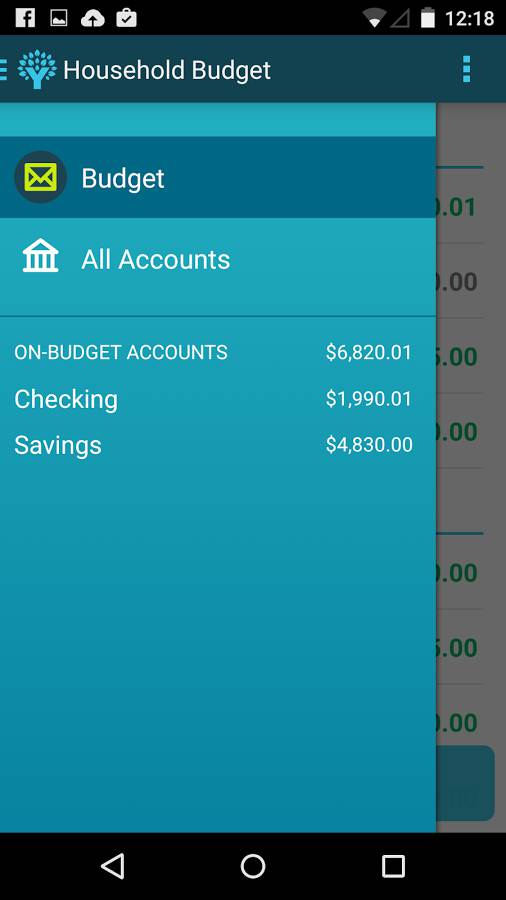

You Need A Budget is the companion app for the desktop program of YNAB, which attempts to bring users a completely unique way of budgeting to promote more successful budgeting. The app easily syncs with desktop app,(which costs $60 and is required to use this app, although the YNAB Android app is free)allowing you to see your budget updates in real-time. The app has a sort of offline mode available that will allow it to “catch up” as soon your phone finds a connection. You can sync things to the cloud via Dropbox so you have your personal finances stored, and you can easily add transactions on the go, as well as enter split purchases.

You can check your category balances before every purchase and view transactions across all accounts. YNAB also lets you view all historical transactions for every account so you can stay aware of your spending. The app promotes a few key factors or “simple rules” of budgeting, like getting in a habit of using last months money for this months bills, essentially paying ahead of time in a sense so that when bills come due they’re technically already paid. Other rules include giving every dollar you have incoming from your salary or pay checks a job so you aren’t tempted to spend outside of your budget, planning for less frequent, bigger expenses by splitting them into monthly chunks instead of one large sum when it’s due, and rolling with the punches which aims to help you start off with the right foot in the next month by keeping you on track should you over spend in a budget category. YNAB also lets you seamlessly switch between personal and business finance accounts so you can keep track of multiple budgets without worry while keeping things separate.

The post Android Epic App Battle: Mint.com V.S. You Need A Budget appeared first on AndroidHeadlines.com |.

from AndroidHeadlines.com | http://ift.tt/145A9xe

No comments:

Post a Comment